There’s nothing quite like the knot in your stomach when your brand-new iPhone slips from your hand, or the sudden panic when your MacBook takes an unexpected dive into a spilled drink. In an era where our devices are extensions of ourselves, protecting them isn't just about avoiding a hefty repair bill; it's about safeguarding our connectivity, productivity, and peace of mind. But with so many options, how do you choose between AppleCare vs. Third-Party Warranties & Home Insurance?

This isn't just another dry comparison. We’re going to cut through the jargon and get straight to what matters: understanding your choices so you can make a smart, confident decision that truly protects your tech – and your wallet.

At a Glance: Your Device Protection Options

- AppleCare+: Manufacturer-backed, predictable costs for accidental damage ($29 screen, $99 others), priority support, original parts. Best for simplicity and preserving resale value.

- Third-Party Extended Warranties: Covers mechanical failures after manufacturer warranty, typically no accidental damage or theft. Good for careful users worried about hardware defects.

- Third-Party Gadget Insurance: Broadest coverage, including accidental damage, theft, and loss. Involves monthly premiums and deductibles. Ideal for accident-prone individuals or those worried about theft.

- Homeowners/Renters Insurance: May cover devices against specific perils (fire, theft), but high deductibles and potential premium hikes often make it a poor choice for minor device claims.

- Out-of-Pocket: No upfront costs, but you bear the full expense of repairs or replacement. Best for very careful users or those who upgrade frequently.

The Device Protection Maze: Why It’s More Than Just a Warranty

Your smartphone, laptop, or tablet isn't just a gadget; it's an investment, a lifeline, and often, a critical tool for work or personal connection. Modern devices are engineering marvels, but they're also surprisingly fragile and expensive to fix. A cracked screen on a flagship phone can set you back well over $300, and a liquid-damaged laptop might easily cross the $800 mark – sometimes costing nearly as much as a new device.

This financial reality drives the need for protection. But the landscape of device coverage is varied and, frankly, a bit confusing. You have manufacturer plans, specialized insurance policies, general home insurance policies, and the option to simply gamble and pay for repairs as they happen. Each path has its own set of rules, costs, and limitations. Our goal here is to demystify these options, helping you weigh the risks and rewards to find the perfect fit for your lifestyle and devices.

Decoding AppleCare+: The Manufacturer’s Promise

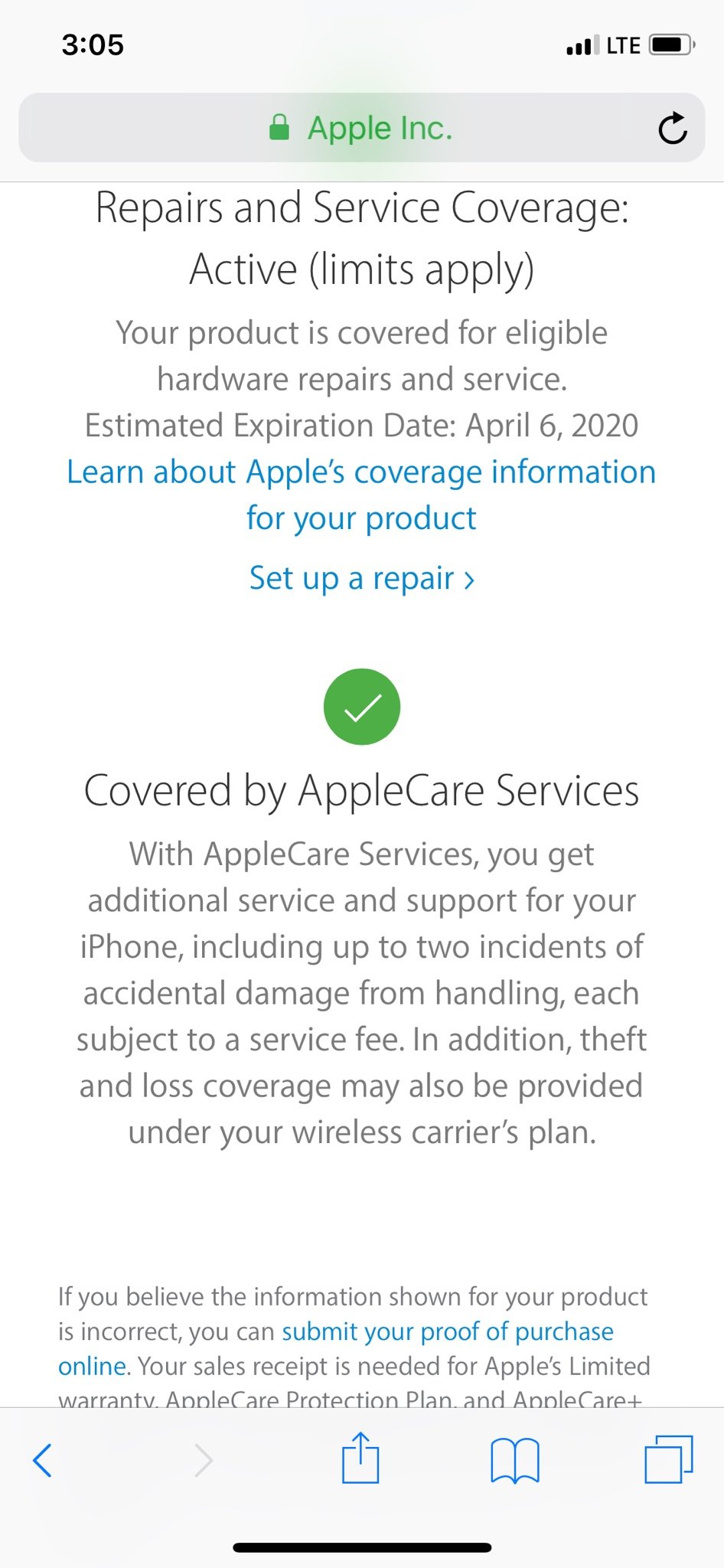

When you buy an Apple product, AppleCare+ is the first protection plan you’ll likely encounter. It’s Apple’s own extended warranty and insurance program rolled into one, designed to give you peace of mind directly from the source.

What AppleCare+ Offers

AppleCare+ goes beyond the standard one-year limited warranty that comes with every Apple product. While the limited warranty covers manufacturing defects, AppleCare+ adds a crucial layer of protection:

- Extended Warranty Coverage: It typically extends your hardware warranty coverage and complimentary technical support for two or three years from your purchase date, depending on the device. This means if your iPhone battery degrades significantly, or your MacBook keyboard malfunctions due, you're covered for longer.

- Accidental Damage Protection: This is where AppleCare+ truly shines. For a fixed, predictable service fee, Apple covers accidental damage. For iPhones and iPads, a screen repair might cost just $29, while other accidental damage (like liquid spills or casing damage) typically costs $99. For Macs, accidental damage service fees usually range from $99 to $299, depending on the specific repair. You generally get a certain number of accidental damage incidents covered over the plan's duration.

- Priority Support: You get direct, priority access to Apple experts via chat or phone for software support, troubleshooting, and advice.

- Genuine Parts and Certified Repairs: All repairs are performed by Apple-certified technicians using genuine Apple parts. This ensures the quality, safety, and longevity of your device, and importantly, preserves its resale value.

- Convenient Service Options: Apple offers various repair options including carry-in service at an Apple Store, mail-in service, or even express replacement service where you receive a replacement device before sending yours in.

What AppleCare+ Doesn't Cover (or Requires an Upgrade)

Standard AppleCare+ does not cover theft or loss. For that, you’d need to opt for AppleCare+ with Theft and Loss, which is a more expensive tiered plan. This specific plan leverages Apple’s "Find My" feature to verify loss or theft before replacement. It's crucial to understand this distinction when choosing your plan.

Who is AppleCare+ For?

- The Simplicity Seeker: If you want the easiest, most straightforward repair experience with no surprises or third-party headaches, AppleCare+ is your best bet.

- The Accident-Prone: For those who frequently drop their phone or spill coffee near their laptop, the low, fixed accidental damage fees are incredibly appealing.

- The Resale Value Conscious: Devices repaired with genuine Apple parts by Apple-certified technicians maintain their value much better than those repaired by unauthorized third parties.

- The Apple Ecosystem User: If you own multiple Apple devices, Apple occasionally offers bundled plans like "AppleCare One" which could cover up to three devices for a monthly fee (e.g., $19.99/month), potentially making it more cost-effective than individual plans.

- The Traveler: If you travel frequently, knowing you can get official Apple support and repairs globally offers significant peace of mind.

Pros of AppleCare+: - Guaranteed genuine parts and expert service.

- Predictable, low service fees for accidental damage.

- Priority customer support.

- Preserves device resale value.

- Easy claims process.

Cons of AppleCare+: - More expensive upfront than some third-party options.

- Theft and loss require an even pricier upgraded plan.

- Tied to the specific device it covers.

Beyond Apple: Navigating Third-Party Extended Warranties

An extended warranty is a service contract that covers the repair or replacement of eligible products after the manufacturer's original warranty expires. Unlike AppleCare+, which blends warranty and accidental damage protection, most basic third-party extended warranties are primarily focused on hardware failures, not drops or spills.

What Third-Party Extended Warranties Offer

These plans are typically offered by retailers (like Best Buy's Geek Squad Protection) or independent warranty providers.

- Extended Mechanical Failure Coverage: The core benefit is extending protection against manufacturing defects and mechanical failures (like a faulty battery, screen defects not caused by drops, keyboard issues, or camera lens malfunctions) beyond Apple’s standard one-year warranty.

- Predictable Upfront Cost: You generally pay a one-time fee, typically ranging from $50 to $300, for 1 to 3 years of coverage. This can offer peace of mind if your primary concern is a hardware component failing prematurely.

What Third-Party Extended Warranties Typically Don't Cover

This is where the distinction becomes critical. Most basic extended warranties do not cover accidental damage, theft, or loss. If you crack your screen or drop your device in water, a standard extended warranty won't help you. Some providers might offer "accidental damage from handling" (ADH) as an add-on, but this usually increases the cost and has its own limitations.

Additionally, the repair process can be more variable. You might be directed to authorized third-party repair shops, and while they may use quality parts, they might not always be genuine Apple components, which could impact future repairs or resale value.

Who is a Third-Party Extended Warranty For?

- The Careful User: If you are meticulous with your devices, use protective cases, and rarely experience accidental damage, but still worry about a component failing after the manufacturer warranty expires.

- The Budget-Conscious (for specific risks): If a single upfront payment for mechanical failure coverage is appealing and you want to avoid monthly premiums.

- Those with Older Devices: Sometimes, you can purchase an extended warranty for a device that's older than 60 days, which might be past the enrollment window for AppleCare+.

Pros of Third-Party Extended Warranties: - One-time upfront payment.

- Can be cheaper than AppleCare+ if you only need mechanical defect coverage.

- Offers peace of mind for hardware failures beyond the initial warranty.

Cons of Third-Party Extended Warranties: - Typically no coverage for accidental damage, theft, or loss.

- Repair quality and parts can vary by provider.

- Claims process can be slower or more complex than with Apple.

- Coverage might overlap with existing manufacturer warranty for the first year.

Comprehensive Shield: Third-Party Gadget Insurance

Third-party gadget insurance, often provided by specialized insurance companies, offers a much broader scope of protection than an extended warranty. Think of it more like a dedicated property insurance policy for your electronics.

What Gadget Insurance Offers

- Broad Coverage: This is the main appeal. Gadget insurance typically covers mechanical issues, accidental damage (cracked screens, water damage, drops), theft, and loss. Some premium policies might even cover software repair or data recovery services.

- Flexibility: You can often insure multiple devices under one policy, or insure older devices that no longer qualify for manufacturer plans.

- Lower Upfront Cost: Instead of a large lump sum, you pay monthly premiums, usually ranging from $5-$20 per device. This can make it more accessible initially.

- Local Repair Options: Many policies allow you to choose your own repair shop (after approval) or direct you to local authorized repair centers, which can be convenient if you're not near an Apple Store.

The Trade-offs of Gadget Insurance

While comprehensive, gadget insurance comes with its own set of considerations:

- Deductibles: While premiums are monthly, you’ll almost certainly pay a deductible for each claim, which can range from $50 to $250. Over time, combined premiums and deductibles can add up, potentially surpassing the cost of a device repair.

- Premiums Add Up: Monthly payments accumulate. If you don't make a claim, you've paid premiums without direct benefit.

- Claims Process Scrutiny: Insurers often require extensive documentation (police reports for theft, proof of purchase, detailed damage descriptions) and claims can be slower than AppleCare+. Some providers have less consistent customer service or may look for reasons to deny claims.

- Aftermarket Parts: Unless specified, repairs might use aftermarket or refurbished parts rather than genuine manufacturer components. This can impact device performance, warranty (for future issues), and resale value.

Who is Third-Party Gadget Insurance For?

- The Accident-Prone and Worried About Theft/Loss: This is the best option if comprehensive coverage – including theft and loss – is your absolute priority.

- Frequent Travelers: If you're constantly on the go and your devices are at higher risk in various environments.

- Those Not Near Apple Stores: If you prefer the convenience of local repair shops over shipping your device to Apple or visiting a distant Apple Store.

- Owners of Older Devices: Since AppleCare+ has a limited enrollment window (typically 60 days post-purchase), gadget insurance can protect older tech.

Pros of Third-Party Gadget Insurance: - Most comprehensive coverage (accidental, mechanical, theft, loss).

- Lower initial upfront cost with monthly premiums.

- Can cover older devices or multiple devices.

Cons of Third-Party Gadget Insurance: - Monthly premiums add up; total cost can exceed device value over time.

- Deductibles apply to each claim.

- Claims process can be slower and more arduous.

- Repairs may use aftermarket parts, potentially affecting quality and resale value.

Your Home Insurance Policy: A Hidden Safety Net (or Trap)?

Many homeowners and renters overlook their existing insurance policies as a potential source of device protection. While these policies can cover personal property, including electronics, it’s rarely the ideal solution for protecting your daily gadgets.

How Home Insurance Might Help

- Broad Perils Coverage: Homeowners or renters insurance policies typically cover personal property against a range of "perils" such as fire, theft (especially off-premises theft), vandalism, and sometimes specific types of accidental damage that occur within your home.

- Scheduled Personal Property: For very expensive items (high-end cameras, unique jewelry, or even a high-value laptop if specifically itemized), you can sometimes add "scheduled personal property" coverage. This offers broader protection, often with lower or no deductible for that specific item, but it increases your premium.

Why It’s Usually Not the Best Option for Devices

- High Deductibles: Standard home insurance deductibles often range from $500 to $2,500. If your phone breaks and costs $800 to replace, filing a claim with a $1,000 deductible means you'd pay the full repair cost yourself anyway, rendering the coverage useless for smaller claims.

- Impact on Premiums: Filing a claim, especially multiple claims, can lead to your insurance premiums increasing significantly at renewal time. Insurers often view frequent claims as a higher risk.

- Specific Exclusions: Policies may have exclusions for certain types of damage (e.g., mysterious disappearance, normal wear and tear, or even specific accidental damage scenarios). Some policies might have a sub-limit for electronics, meaning they’ll only pay up to a certain amount regardless of the device’s actual value.

- Claims History: A claim on your home insurance becomes part of your insurance history, which can affect your ability to get favorable rates for future policies (auto, home, etc.).

- No Accidental Damage (Often): While theft is usually covered, basic accidental damage (like dropping your phone) is often not covered unless it’s a specific add-on or a scheduled item with "all perils" coverage.

When to Consider Your Home Insurance

- Catastrophic Loss: If your entire house burns down, or a major theft occurs where multiple high-value items (including your devices) are stolen, then your home insurance is absolutely the right avenue.

- Very High-Value, Specialized Equipment: For a professional photographer with a $10,000 camera rig, scheduling that specific item under their home policy might be a viable option, given the potential for broad coverage and a favorable deductible.

Pros of Homeowners/Renters Insurance: - Already have it, so no extra monthly premium for basic coverage.

- Covers a wide range of perils, including theft, for personal property.

Cons of Homeowners/Renters Insurance: - High deductibles make it impractical for most device claims.

- Filing claims can increase future premiums.

- Doesn't usually cover simple accidental damage (drops, spills).

- Impacts your overall insurance claims history.

- Often only suitable for catastrophic loss, not everyday device incidents.

The DIY Approach: Paying Out-of-Pocket

Sometimes, the best plan is no plan. This strategy involves taking the full financial risk yourself, opting to pay for any repairs or replacements out of your own pocket if and when damage occurs.

How It Works

It's straightforward: you don't pay any monthly premiums, one-time fees, or deductibles upfront. If your device breaks, you pay the full repair cost at an Apple Store, an authorized repair center, or a third-party shop. If it's beyond repair or stolen, you pay for a full replacement.

The Risks and Rewards

- Savings if You're Lucky: For careful users, this can be the cheapest option in the long run. If you never damage your devices, you save years of premiums and deductibles.

- Potentially Huge Bills: The downside is significant financial exposure. A single cracked screen (over $300 for many iPhones) or a liquid-damaged laptop ($500-$1000+) can quickly wipe out years of "savings" from not having a plan. If your device is stolen or lost, you're on the hook for a completely new one, which can be over $1,000 for high-end models.

- Unpredictability: You trade predictable, smaller payments for the unpredictable risk of a single, large bill.

Who is the Out-of-Pocket Approach For?

- The Extremely Careful User: You use robust cases, screen protectors, and treat your devices like fragile artifacts. You have a proven track record of rarely damaging electronics.

- The Frequent Upgrader: If you upgrade your device every year or two, you might not feel the need for extended coverage, as the device will be replaced before many issues arise. The initial year is covered by Apple's limited warranty for defects.

- Those Comfortable with Financial Risk: You have an emergency fund specifically for unexpected expenses and are comfortable absorbing the full cost of a repair or replacement without financial strain.

- Owners of Low-Cost or Easily Replaceable Devices: For a cheaper tablet or an older phone that isn't mission-critical, the cost of protection might outweigh the cost of replacement.

Pros of Paying Out-of-Pocket: - No upfront costs, premiums, or deductibles.

- Cheapest option if you never break or lose your device.

- Freedom to choose any repair shop or replacement device.

Cons of Paying Out-of-Pocket: - Full financial responsibility for all repairs or replacements.

- A single incident can be extremely expensive.

- No protection against theft or loss.

- High unpredictability in costs.

Making Your Call: A Decision Framework for Device Protection

Choosing the right protection plan isn't a one-size-fits-all decision. It hinges on several personal factors: your budget, your risk tolerance, your device usage habits, and your specific concerns.

Key Factors to Consider

- Device Value: How much would it cost to repair or replace your device? The higher the value, the more compelling protection becomes.

- Your Risk Profile:

- Are you accident-prone? (Frequent drops, spills) – Leans towards AppleCare+ or Gadget Insurance.

- Are you worried about theft/loss? – Strongly points to Gadget Insurance or AppleCare+ with Theft and Loss.

- Are you careful but worry about defects? – Extended Warranty might suffice.

- Budget:

- Prefer predictable, low repair costs? – AppleCare+.

- Prefer lower upfront cost, higher deductible? – Gadget Insurance.

- Prefer a one-time payment for specific coverage? – Extended Warranty.

- Prefer no payments, but high risk? – Out-of-pocket.

- Convenience and Repair Quality: Do you want guaranteed genuine parts and official service (AppleCare+)? Or are you okay with third-party repairs that might use aftermarket parts (Gadget Insurance, Extended Warranty)?

- Device Age: Most manufacturer plans have a limited enrollment window. Older devices might only qualify for third-party gadget insurance.

- Existing Coverage: Check your credit card benefits! Many premium credit cards offer extended warranty or accidental damage protection for purchases made with that card, often for 90-120 days. This could be a good safety net for new devices.

Comparative Table: Device Protection Options

| Feature | AppleCare+ | Extended Warranty (Third-Party) | Gadget Insurance (Third-Party) | Homeowners/Renters Insurance (Device Aspect) | Out-of-Pocket |

|---|---|---|---|---|---|

| Primary Coverage | Accidental damage, mechanical defects | Mechanical defects | Accidental damage, mechanical defects, theft, loss | Theft, fire, specific perils (limited accidental) | None |

| Cost Structure | Upfront plan fee + fixed service fees/deductibles | One-time upfront fee | Monthly premiums + deductible per claim | Existing premiums + high deductible per claim | Full cost of repair/replacement |

| Theft/Loss | Only with upgraded "Theft & Loss" plan | No | Yes (typically) | Yes (for covered perils like theft, with high deductible) | No |

| Accidental Damage | Yes (fixed, low service fees) | Rarely (unless specific add-on) | Yes (with deductible) | Rarely (unless specific riders/perils) | Full cost |

| Repair Quality | Genuine Apple parts, certified technicians | Varies, may use aftermarket parts | Varies, may use aftermarket parts | Varies based on claim payout, local shop choice | Varies based on your choice |

| Claims Process | Easiest, most direct with Apple | Can be slower, more documentation | Can be slower, requires documentation, variable provider | Complex, impacts premiums, high deductible | You arrange and pay |

| Resale Value | Preserved (official repairs) | Can be impacted by non-genuine parts | Can be impacted by non-genuine parts | N/A | Can be impacted by non-genuine parts (if you use them) |

| Ideal For | Simplicity, accident-prone, resale value focus | Careful users worried about hardware failure | Accident-prone, theft/loss concern, comprehensive coverage | Catastrophic loss, very high-value scheduled items | Very careful users, frequent upgraders |

Who Should Choose What: A Quick Guide

- Choose AppleCare+ if you: Prioritize ease, guaranteed Apple-quality repairs, predictable accidental damage costs, and preserving your device’s resale value. You're comfortable with an upfront fee and don't want the hassle of dealing with third-party providers. You can upgrade for theft/loss coverage if needed.

- Choose a Third-Party Extended Warranty if you: Are extremely careful with your device but want protection against hardware defects after the initial manufacturer warranty expires. You prefer a one-time payment and aren't concerned about accidental damage, theft, or loss coverage from this specific plan.

- Choose Third-Party Gadget Insurance if you: Need the most comprehensive coverage, including theft and loss, alongside accidental damage and mechanical failure. You prefer lower monthly payments over a large upfront cost and are comfortable with deductibles. You might also have an older device ineligible for AppleCare+.

- Rely on Homeowners/Renters Insurance only if you: Are dealing with a catastrophic event where multiple items are lost or damaged, and the repair cost significantly exceeds your high deductible. Do not use it for a cracked screen.

- Choose to Pay Out-of-Pocket if you: Are exceptionally careful with your devices, upgrade frequently, or have a robust emergency fund and are comfortable absorbing potentially large, unpredictable repair or replacement costs.

Dispelling Myths & Answering FAQs

Navigating device protection brings up many questions. Let's tackle some common ones.

"Does my credit card offer protection?"

Possibly! Many premium credit cards (especially those with annual fees) offer extended warranty benefits, purchase protection (for accidental damage or theft within the first 90-120 days), or even cell phone protection if you pay your monthly bill with that card. Always check your specific credit card's benefits guide before purchasing additional coverage, as this could save you money.

"Is AppleCare+ always worth it?"

Not always, but often. For high-value, frequently used devices like iPhones and MacBooks, AppleCare+ provides significant value, especially with its low accidental damage fees and genuine repairs. For lower-cost accessories, or if you're extremely careful and have a history of never damaging devices, it might be overkill. The perceived value also changes drastically if you factor in even one accidental repair.

"Are third-party repairs as good as Apple's?"

Not necessarily. While many independent repair shops are skilled, only Apple-certified technicians using genuine Apple parts can guarantee the same quality and future compatibility. Aftermarket parts can sometimes lead to issues with performance, features (like Face ID), or even void future official Apple repairs.

"If I get gadget insurance, does it cover everything?"

Gadget insurance is comprehensive but not limitless. Always read the fine print. There might be claim limits, specific exclusions (e.g., leaving your device unattended in public), or requirements for proof of ownership/theft. Some policies may not cover "mysterious disappearance" without proof of theft.

"Will filing a claim on my home insurance really raise my premiums?"

Yes, it's a strong possibility. Insurance companies use claims history to assess risk. Even a small claim can flag you as a higher risk, potentially leading to increased premiums at renewal time, or even making it harder to get new insurance policies in the future. It's generally advised to only use home insurance for substantial claims.

The Future of Device Protection: What's Next?

The device protection market is constantly evolving to meet consumer demands and technological advancements. We're seeing several interesting trends:

- Bundled Warranty and Insurance Plans: Providers are increasingly offering hybrid plans that combine elements of extended warranties and gadget insurance, simplifying choices for consumers.

- Subscription Models: More companies are moving towards flexible, monthly subscription models for device protection, making it easier to integrate into recurring household budgets.

- Eco-Friendly Options: As sustainability gains importance, some plans are offering incentives for repair over replacement, sometimes with discounts on eco-friendly repair options.

- AI-Powered Claims Processing: Leveraging artificial intelligence and machine learning to speed up claims verification and processing, aiming for faster payouts or repairs.

- Customizable Coverage: The ability to tailor protection plans for specific risks (e.g., just theft, or just accidental damage for certain types of users) is becoming more prevalent, allowing consumers to pay only for what they truly need.

These trends aim to make device protection more accessible, efficient, and personalized, but the core decision-making principles will remain: understanding what you're buying, what it covers, and if it aligns with your personal risk and budget.

Your Next Step: Protecting Your Precious Tech

Choosing between AppleCare, third-party warranties, gadget insurance, or relying on your home policy can feel overwhelming. But by understanding the nuances of each option and honestly assessing your own habits and priorities, you can make an informed decision.

Take a moment to consider:

- What device are you protecting? Its value and how critical it is to your daily life.

- How do you use it? Are you generally careful, or do you have a history of accidents?

- What are your biggest fears? A cracked screen? A stolen device? A total hardware failure?

- What's your budget? Are you comfortable with upfront costs, monthly premiums, or the risk of a large, one-time repair bill?

There's no single "right" answer, only the right answer for you. Whether it's the seamless experience of AppleCare+, the broad shield of gadget insurance, or the calculated risk of going without, your decision should bring you peace of mind, knowing your digital life is safeguarded. Don't let uncertainty leave your valuable tech vulnerable. Equip yourself with the right protection today.