There’s a stomach-dropping moment almost every smartphone owner knows: the sudden slip, the sickening thud, and the slow dread as you flip over your device to survey the damage. Or worse, the frantic pat-down of empty pockets, realizing your digital lifeline is gone. For many Apple users, the immediate thought turns to AppleCare+. It's a familiar comfort, often purchased impulsively alongside a new iPhone. But what if there were robust, often more flexible, alternatives to AppleCare for device protection that could save you money, cover more scenarios, or simply fit your tech lifestyle better?

Choosing the right protection plan for your iPhone, iPad, Mac, or Apple Watch can feel like navigating a maze. While AppleCare+ offers a premium, integrated experience, it's not the only game in town—and for many, it might not even be the best fit. Let's break down your options, uncover the hidden gems, and empower you to protect your prized devices smartly.

At a Glance: Quick Takeaways for Smart Device Protection

- AppleCare+ is Premium, but Restrictive: Offers Apple-certified repairs and support, but limited loss/theft claims, a 60-day activation window, and higher costs.

- US Mobile Protect is the All-Rounder: Covers any device (new, used, refurbished, any brand, any age), offers truly unlimited loss/theft/damage claims, flexible repair options (including Apple Stores), and can be activated anytime. Often significantly cheaper.

- Carrier Plans Offer Convenience: T-Mobile, AT&T, and Verizon provide plans that bundle easily with your monthly bill, but often have claim limits, higher costs, and specific repair networks.

- Third-Party Insurers Provide Cost Savings: Companies like Mulberry, SquareTrade, AKKO, and Upsie often have lower monthly premiums but may come with trade-offs in repair networks or access to OEM parts.

- Consider Your Device & Habits: Your choice should depend on whether your device is new or used, how prone you are to accidents, and your preference for repair locations and parts.

- OEM Parts Matter: Repairs with non-OEM (Original Equipment Manufacturer) parts can impact your device's warranty, performance, and the resale value of your smartphone.

Understanding AppleCare+: The Benchmark for Device Protection

AppleCare+ sets the standard for integrated device protection within the Apple ecosystem. It’s a compelling option, especially when you're buying a brand-new device.

What AppleCare+ Offers in 2025:

- Unlimited Accidental Damage: You get unlimited accidental damage repairs, covering everything from a cracked screen to liquid spills.

- Loss & Theft Coverage: For those truly unfortunate incidents, AppleCare+ includes up to two claims for loss or theft per year.

- Predictable Deductibles: Repairs for a cracked screen or back glass will typically cost you $29, while other accidental damage repairs are $99. If your device is lost or stolen, the deductible jumps to $149.

- Apple-Exclusive Support & Repairs: You’ll receive 24/7 priority access to Apple support and can get same-day repairs directly at Apple Stores or Apple Authorized Service Providers. This guarantees genuine Apple parts and certified technicians.

- Battery Coverage: If your battery's capacity falls below 80% of its original specification, AppleCare+ covers its replacement.

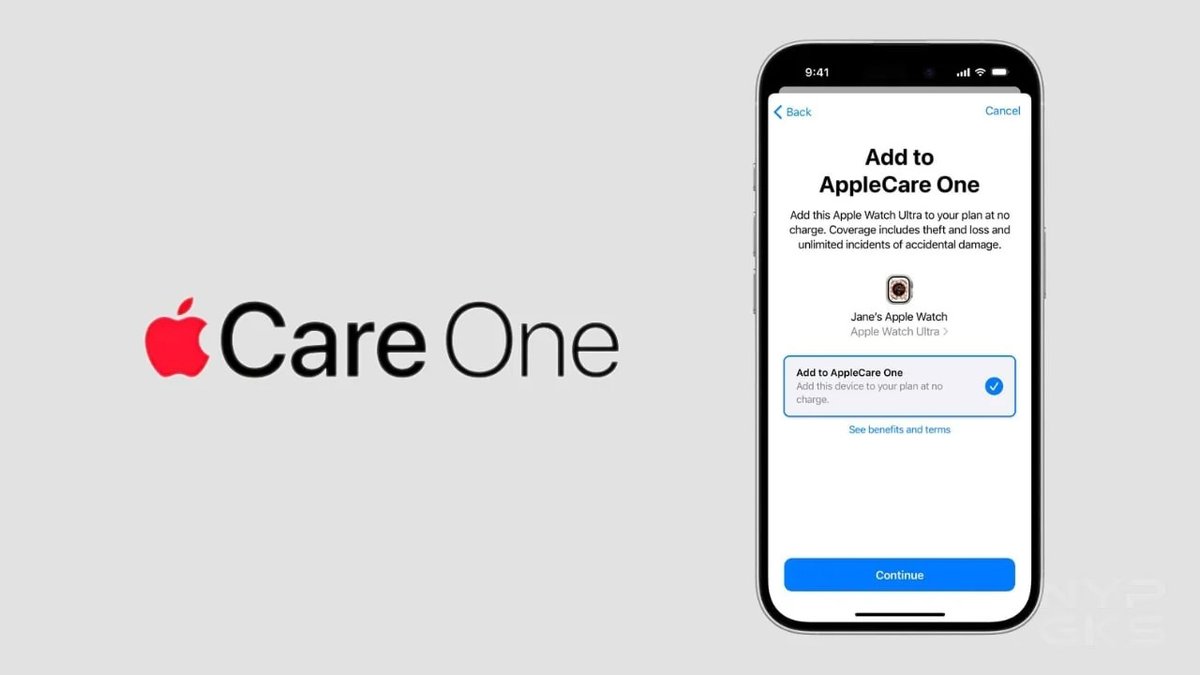

- Bundling Options: For households with multiple Apple devices, AppleCare One offers a streamlined solution, covering three Apple devices for $19.99/month, with additional devices at $5.99 each.

- Activation Window: A key restriction: AppleCare+ must typically be purchased and activated within 60 days of your device’s original purchase. This usually excludes used or older devices.

- Pricing: Expect around $13.99/month or $139.99/year for standard coverage.

Who AppleCare+ Is Best For:

If you own a brand-new Apple device, prioritize using official Apple repair channels, and appreciate the peace of mind that comes with direct Apple support, AppleCare+ is an excellent choice. It’s also ideal if you rarely lose your devices (as you’re limited to two loss/theft claims annually) and are comfortable with the 60-day activation window for new purchases.

Why Look Beyond AppleCare? The Case for Alternatives

While AppleCare+ offers a polished experience, its structure doesn't suit everyone. Here's why many savvy consumers start exploring alternatives:

- Cost Considerations: AppleCare+ isn't cheap. Its monthly or annual premiums, combined with deductibles, can add up, especially if you rarely damage your devices.

- Limited Loss/Theft Claims: The cap of two loss/theft claims per year can be a significant drawback for those who are particularly prone to misplacing or having their devices stolen.

- Activation Restrictions: The 60-day activation window means you can't add AppleCare+ to an older, used, or refurbished device, leaving a large segment of the market unprotected by Apple directly.

- Repair Network Exclusivity: While Apple-certified repairs are a perk for some, being limited to Apple Stores or authorized providers might not always be the most convenient option, particularly in rural areas or during busy times.

- Multi-Device & Multi-Brand Households: If you have a mix of Apple and Android devices, or older phones alongside new ones, AppleCare+ only covers your Apple gear, forcing you to find separate solutions.

These factors open the door for a diverse landscape of alternatives, each with its own strengths.

Top-Tier Alternatives: A Deep Dive into Your Options

The market for device protection has evolved significantly beyond just manufacturer plans. You have strong choices from independent providers and carrier-specific offerings.

US Mobile Protect: The Flexible All-Rounder

If you're looking for a genuine contender that often outpaces AppleCare+ in flexibility and coverage, US Mobile Protect is a standout. It's built for the modern multi-device user.

Key Features of US Mobile Protect:

- Universal Device Coverage: This is a game-changer. US Mobile Protect covers any device—new, used, refurbished, any age, any brand. Whether it’s an iPhone from three years ago or a brand-new Android, you’re covered.

- Truly Unlimited Claims: Unlike most plans, US Mobile Protect offers unlimited claims for loss, theft, and damage. There's no annual cap, providing unparalleled peace of mind.

- Flexible Repair Locations: You're not tied to a specific network. You can opt for repairs at Apple Stores (often with OEM parts), carrier-authorized repair centers, or a local repair shop of your choice.

- Anytime Activation: Forget the 60-day window. You can add US Mobile Protect to your device at any time, making it perfect for protecting existing devices or new acquisitions.

- Affordable Pricing: At $7.50/month or $75/year (and a highly competitive $36 for the first year), it often undercuts AppleCare+ significantly.

- Consistent Deductibles: Deductibles mirror AppleCare+'s: $29 for cracked screen/back glass, $99 for other damage, and $149 for loss/theft.

- Family/Multi-Line Bundles: Designed with families and businesses in mind, US Mobile Protect offers convenient bundles to cover multiple lines or devices.

- Flexibility: Cancel anytime, and your coverage follows your line or account.

Who US Mobile Protect Is Best For:

This plan is ideal for anyone who owns a mix of new, used, or refurbished phones, or devices from different brands. It’s perfect for families, teams, or individuals who want truly "always-on" protection without the typical claim limits. If flexibility in repairs (including the option for Apple Store repairs) and the lowest price point are priorities, US Mobile Protect should be at the top of your list.

Carrier-Specific Plans: Convenience with Caveats

Most major carriers offer their own device protection plans, often bundling them with other services. They can be convenient if you're already committed to a carrier, but understand their specific terms.

T-Mobile Protection 360

- Coverage: Protects phones, tablets, watches, and even accessories.

- Claims: Unlimited accidental damage claims per year, with a notable $0 front/back glass repair for eligible models. You get 2 loss/theft claims annually.

- Limits: Claim limits up to $2,000 per repair/replacement, with an annual cap of $5,000.

- Apple Benefits: Includes some AppleCare benefits for recent iPhones, making it a hybrid option for T-Mobile's Apple users.

- Pricing: Monthly prices typically range from $7–$18 per phone, depending on the device tier.

- Repairs: Options include authorized service centers and, on select plans, Apple Stores.

Who T-Mobile Protection 360 Is Best For: T-Mobile customers who want a single bill for phone service and protection, appreciate $0 screen repairs on newer devices, and find the 2 loss/theft claims sufficient.

AT&T Protect Advantage

- Coverage: Covers most premium and popular brands, including Apple devices.

- Claims: Offers unlimited claims, up to $3,500 per device/claim. Includes $0 screen/battery repair for eligible models. Other repairs can range from $100–$400+.

- Loss/Theft: Provides 2 loss/theft claims per year.

- Bundles: Multi-device plans are available, making it suitable for families.

- Pricing: Monthly prices are generally $16–$25 for a single device, or around $50 for a multi-device plan.

- Repairs: Options include authorized stores, and some plans may offer Apple OEM repairs with a reimbursement process.

Who AT&T Protect Advantage Is Best For: AT&T customers looking for multi-device family coverage and who value $0 screen/battery repairs on eligible devices, accepting the 2 loss/theft claim limit.

Verizon Mobile Protect

- Coverage: Primarily for new and recent devices, with some eligibility for used/refurbished phones.

- Claims: Stands out with 3 loss/theft claims per year, plus unlimited damage claims.

- Pricing: Monthly costs are between $14–$19.

- Deductibles: Deductibles vary widely, from $19–$279, depending on the device and damage type.

- Repairs: Repair options include Verizon's carrier network and, often, Apple Stores with reimbursement available.

- Flexibility: You can cancel anytime, and coverage remains active as long as you pay.

Who Verizon Mobile Protect Is Best For: Verizon customers who desire a higher cap on loss/theft claims (3 per year) and unlimited damage coverage, while preferring a carrier-backed service.

Common Characteristics of Carrier Plans: - Convenience: Billing is typically integrated with your monthly phone bill.

- Device Specificity: Plans are often tied to specific devices or tiers, with varying pricing and coverage.

- Repair Networks: While some offer Apple Store options (often via reimbursement), the primary repair network is usually the carrier's own authorized technicians, which may or may not use OEM parts.

- Claim Limits: Most carriers impose annual limits on loss/theft claims (typically 2-3 per year).

Independent Third-Party Providers: The Cost-Savers

Beyond carriers and Apple, a robust market of independent third-party insurance providers offers compelling alternatives to AppleCare for device protection. These options often focus on affordability and broader eligibility.

- Mulberry: Known for offering extended warranties, Mulberry often boasts lower prices than AppleCare+. They cover accidental damage, theft, and loss. A unique perk: many online purchases automatically come with a free one-year Mulberry plan. It's subscription-based with unlimited claims. The trade-off might be the lack of direct Apple in-store support.

- SquareTrade: A well-established name, SquareTrade covers accidental damage and malfunctions. They offer longer protection plans and often lower prices for accidental damage, starting around $8.99/month. Deductibles apply, and repairs may not always be Apple-certified.

- AKKO: Specializing in phone insurance, AKKO covers accidental damage, theft, and loss. Their unique selling point is unlimited claims for multiple devices under one plan, generally at a more affordable rate. Their repair network or customer support might be less extensive than Apple’s.

- Upsie: Upsie focuses on affordable device protection with transparent pricing. A key differentiator can be no deductibles for accidental damage on some plans, though coverage limitations might apply.

- Protect Your Bubble: This provider offers comprehensive coverage for accidental damage, theft, and loss, including international coverage. Their monthly premiums are often lower, but be mindful of potentially higher deductibles and repair limitations.

- Asurion: While Asurion partners with many retailers and carriers (including some mentioned above), they also offer direct plans. They are known for quick, often same-day, repairs or replacements for accidental damage, loss, theft, and also provide technical support. They can be more expensive than AppleCare+ and may lack Apple-specific expertise in their direct-to-consumer offerings.

- Allstate Protection Plans: Known for their robust home and auto insurance, Allstate also offers device protection. Their plans cover accidental damage, malfunctions, theft, and loss. They may offer lower prices than AppleCare+, but their repair network and customer support might not be as specialized for Apple devices.

General Pros & Cons of Third-Party Options: - Pros: Often more affordable, broader device eligibility (new, used, various brands), more flexible claim limits, potential for international coverage.

- Cons: Repair networks can vary, genuine OEM parts aren't always guaranteed, customer service may not be as streamlined as Apple's, and the repair process might not be as quick.

Making Your Choice: A Smart Decision Framework

With so many alternatives to AppleCare for device protection, how do you pick the right one? It boils down to understanding your needs, habits, and priorities. Our detailed guide on how to choose the right phone insurance offers even deeper insights, but here are the key questions to ask yourself:

What Kind of Device Do You Have?

- Brand New Apple Device: AppleCare+ is highly convenient here, especially within the 60-day window. However, US Mobile Protect also offers compelling benefits like unlimited claims and lower cost.

- Used, Refurbished, or Older Apple Device: AppleCare+ is generally out. This is where US Mobile Protect shines with its "any device, any age" policy. Third-party providers are also strong contenders.

- Mixed Apple & Android Household: A universal plan like US Mobile Protect makes sense to cover all your devices under one umbrella. Otherwise, you’ll need separate plans.

Your Claim History & Risk Tolerance

- Butterfingers? Often Lose Things? If you frequently damage or lose devices, look for plans with unlimited claims (like US Mobile Protect) or higher claim limits for loss/theft (Verizon Mobile Protect’s 3 claims vs. AppleCare+'s 2).

- Rarely Have Issues? If you’re careful, a lower-cost plan with higher deductibles might save you money in the long run.

Budget vs. Peace of Mind

- Monthly Costs: Compare the monthly or annual premiums. Some plans are significantly cheaper than AppleCare+.

- Deductibles: Don't just look at the premium. A $10/month plan with a $200 deductible might be more expensive in the event of a claim than a $15/month plan with a $99 deductible.

- Total Cost of Ownership: Consider the full picture: premium + potential deductibles + the cost of a full replacement if uninsured.

Repair Preferences

- Apple Store is a Must: If you insist on official Apple Store repairs and genuine OEM parts, AppleCare+ offers the most direct route. However, US Mobile Protect also facilitates Apple Store repairs.

- Flexibility is Key: If you prefer the option of a local shop, mail-in service, or a carrier-authorized center, then US Mobile Protect, carrier plans, and many third-party options offer more flexibility.

OEM Parts & Resale Value

OEM (Original Equipment Manufacturer) parts are components directly from your phone’s brand (e.g., Apple). Using them preserves your device's warranty, ensures optimal performance, and maintains higher resale value. Some third-party repairs may use aftermarket parts, which can void remaining warranties or affect future trade-in values. Always ask about the type of parts used. For many, preserving your device's resale value is a key part of smart ownership.

Beyond Phones: What Else Needs Protecting?

Remember, device protection isn't just for phones. Many plans cover tablets, smartwatches, and laptops. If you have an ecosystem of devices, a plan that covers multiple items (like AppleCare One, US Mobile Protect bundles, or AKKO's multi-device plan) could be more cost-effective.

FAQs: Common Questions, Clear Answers

Is device insurance worth it?

For many, yes. When you consider the cost of a new premium smartphone ($800-$1200+), paying a monthly premium of $7-$20 to protect against accidental damage, loss, or theft can be a wise investment. One significant incident can quickly outweigh years of premiums. However, if you are exceptionally careful and rarely break or lose devices, and are prepared to pay for repairs out-of-pocket, you might save money in the long run by self-insuring.

What's the difference between a warranty and an insurance plan?

This is a crucial distinction. A manufacturer's warranty (like Apple's standard one-year warranty) covers defects in materials or workmanship—essentially, if the device breaks down through no fault of your own. An insurance plan, on the other hand, covers accidental damage (like drops and spills), loss, and theft. Understanding the distinction between a manufacturer's warranty and an insurance plan is key to knowing what you're truly covered for.

Can I get AppleCare+ on a used device?

Generally, no. AppleCare+ must be purchased within 60 days of the device's original purchase and requires inspection if purchased separately from the device. This is a significant limitation, pushing owners of used or refurbished Apple products toward alternatives like US Mobile Protect or other third-party plans.

Do third-party plans use genuine Apple parts?

It varies significantly. Some third-party repair networks might use aftermarket parts to keep costs down. Others, especially those that allow for repairs at Apple Stores (like US Mobile Protect), can facilitate the use of genuine OEM parts. Always confirm the type of parts used before approving a repair, as non-OEM parts can affect performance and future warranty claims.

What happens if my device is lost or stolen?

Most protection plans (including AppleCare+, US Mobile Protect, and carrier plans) cover loss and theft, usually requiring a police report. Upon a successful claim, you'll pay a deductible and receive a replacement device, which may be new or a refurbished model of the same or similar kind. The number of loss/theft claims permitted per year varies by provider.

Your Next Step: Securing Your Digital Life

Choosing the right protection for your devices isn't a one-size-fits-all decision. While AppleCare+ offers a streamlined, premium experience for new Apple devices, a wealth of robust alternatives to AppleCare for device protection exists. Whether you prioritize cost savings, unlimited claims, universal device coverage, or flexible repair options, there's a plan out there tailored to your needs.

When evaluating a new smartphone purchase, or looking to protect an existing one, consider your daily habits, your budget, and how much peace of mind you truly need. Don't simply default to the first option presented. Take the time to compare monthly fees, specific protections, and deductibles. And remember that incorporating best practices for device care into your daily routine can go a long way in minimizing your risk, no matter which plan you choose.

Empower yourself with information, and make an informed decision that keeps your valuable tech safe, secure, and ready for whatever life throws at it.